Introduction:

Artificial Intelligence (AI) is transforming industries worldwide, and the accounting profession is no exception. With increasing demands for accuracy, efficiency, and compliance, AI-powered automation is redefining traditional accounting processes. From automating repetitive tasks to providing deep financial insights, AI is enhancing the way accountants work, making operations more efficient, accurate, and insightful.

How AI is Driving Real Automation in Accounting

Automating Data Entry and Bookkeeping

Manual data entry is one of the most time-consuming tasks for accountants. AI-powered tools can automatically extract, classify, and record financial data from invoices, receipts, and bank statements, reducing human errors and saving hours of manual work.

AI-Driven Financial Reporting and Analysis

AI can analyze vast amounts of financial data and generate reports instantly. With predictive analytics, AI helps accountants identify financial trends, detect anomalies, and provide data-driven insights for better decision-making.

Intelligent Tax Compliance and Audit Support

AI simplifies tax calculations by automatically identifying applicable tax rules, deductions, and exemptions. It also assists in audits by cross-verifying transactions and identifying discrepancies, reducing the risk of fraud and non-compliance.

Automated Invoice Processing and Expense Management

AI-powered tools can scan, validate, and process invoices without human intervention. By integrating with financial software, AI ensures timely approvals and payments, improving cash flow management.

AI-Powered Chatbots for Client Support

Accounting firms are using AI chatbots to provide instant responses to client queries, schedule appointments, and generate automated financial reports. This enhances client experience and allows accountants to focus on high-value tasks.

Fraud Detection and Risk Management

AI and machine learning algorithms can detect unusual financial activities and flag potential fraud. By analyzing transaction patterns, AI helps accountants mitigate risks and enhance financial security.

AI in Forecasting and Financial Planning

AI-driven forecasting models analyze historical financial data and predict future revenue, expenses, and cash flow trends. This allows businesses to make informed financial decisions and plan strategies effectively.

Digitalizing 90,000+ CA Office: A Transformative ICAI Partnership.

Benefits of AI in Accounting

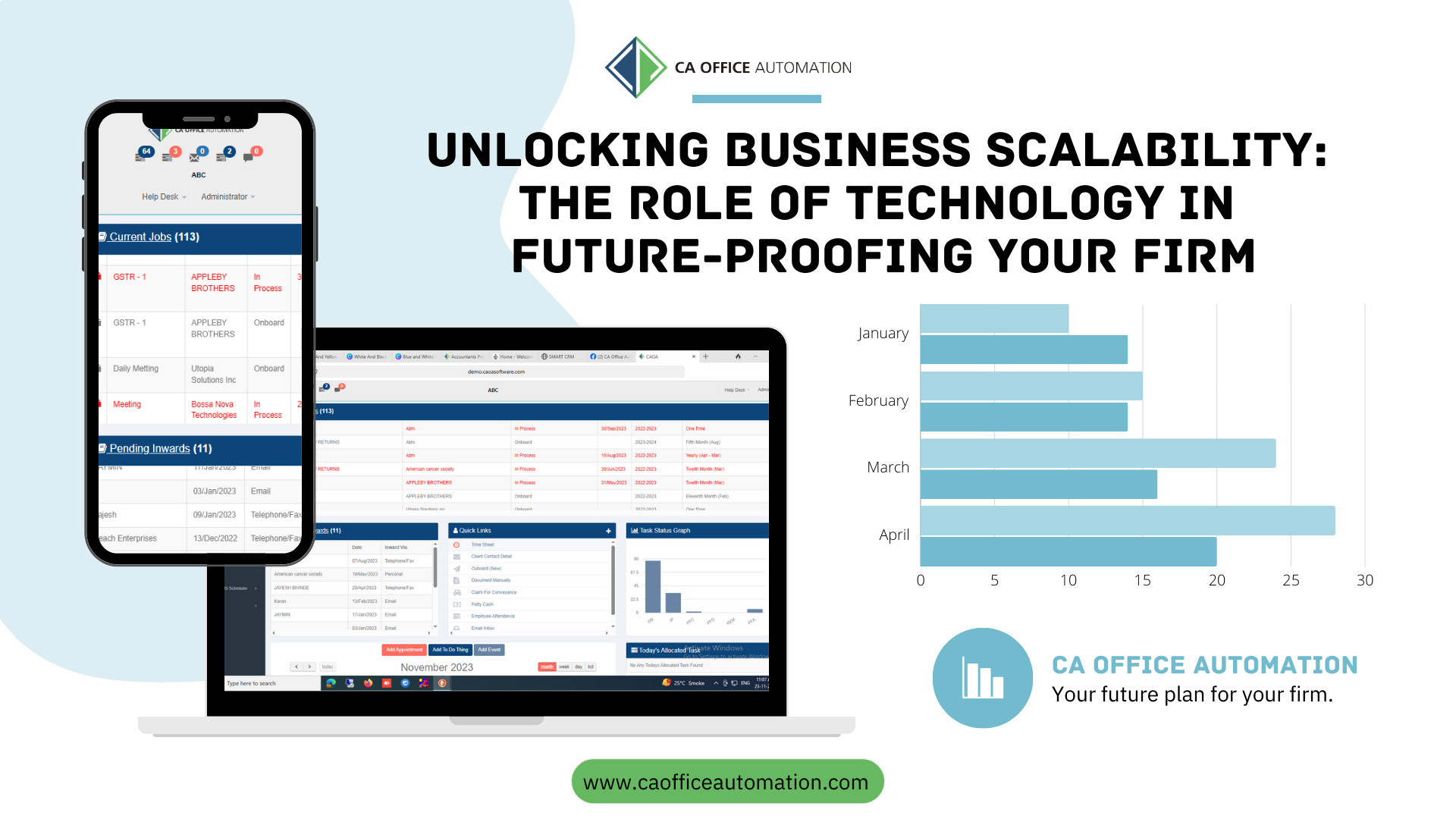

Enhanced Efficiency – AI eliminates repetitive manual tasks, allowing accountants to focus on strategic activities.

Improved Accuracy – AI minimizes human errors, ensuring precise financial reporting and compliance.

Time-Saving – Automation accelerates processes like bookkeeping, tax filing, and audits.

Cost Reduction – AI-driven automation reduces operational costs for accounting firms and businesses.

Better Decision-Making – AI-powered insights help accountants provide valuable financial advice to clients.

Digitalizing 90,000+ CA Office: A Transformative ICAI Partnership.

Conclusion

AI is not replacing accountants; rather, it is empowering them to implementing new technology – work smarter and more efficiently. The integration of AI in accountancy is transforming the industry, making real automation a reality. As AI technology continues to evolve, accounting professionals who embrace automation will stay ahead of the curve, delivering higher-value services and optimizing financial management for businesses.